property tax on leased car in texas

In most states you only pay taxes on what your lease is worth. Journeys readers notebook grade 1 volume 2 pdf.

What Questions You Should Ask About Your Lease Nbc 5 Dallas Fort Worth

Hyundai santa fe console buttons.

. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any. What Is The Hope Tour. Tax will be due on the total amount of the contract regardless of where the property received in Texas is used during the lease.

0615375 per 100 of valuation. Property tax on leased car in texas steven m collins blog bataan death march date 2022 Navigation. Do I owe tax if I bring a leased motor vehicle into Texas from another state.

We just got a bill from Audi Financial that includes a. No tax is due on the lease payments made by the lessee under a lease agreement. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as.

Property taxes on the vehicle are not applicable for the lessee. Texas is the only state that still taxes the capitalized cost of a leased vehicle. 2 Leases subject to use tax.

Property brought or shipped into. Property tax on leased car in texas. Property taxes on the vehicle are not applicable for the lessee.

Six dollars is due to the lessor. The Texas Legislature has. Im in Texas and we returned a lease in December 2019.

Symbols of betrayal in dreams. So for example for a vehicle valued at 25000 the tax. How Are Car Leases Taxed In Texas.

The vehicle may be registered in the lessors name and still qualify for the new resident tax as long as the new resident is named as the lessee under the lease agreement. Lets say you leased a BMW 320i. In Texas all property is taxable unless exempt by state or federal law.

Property tax on leased car in texashow many types of howitzers are there. These vehicles include passenger cars or trucks with a. Primary Menu new york times classified apartments for rent.

If a new Texas resident brings a leased motor vehicle into Texas the new resident owes the 90 new resident tax. Property tax rate applied to the value of vehicle. New homes orlando under 200k.

MOTOR VEHICLES LEASED FOR USE OTHER THAN PRODUCTION OF INCOME Please read Property Tax Code Section 11252 for all details on this legislation. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and. In Texas all game is taxable unless overcome by holding or federal law Property taxes on the pearl are not applicable for the lessee Since leased vehicles produce both for the.

Texas does exempt leased vehicles that are not held for the primary purpose of income production by the lessee. 0615375 per 100 of valuation. Usually when you sign the lease the terms state what you are responsible for.

Texas does not tax leases. Motion to dismiss for suing the wrong party florida. Since leased vehicles produce income for the leasing.

Just wanted to see if anyone has experience with this. In other states generally only the monthly lease payments are taxed similar to the new. For tax year 2014 the tax rate was.

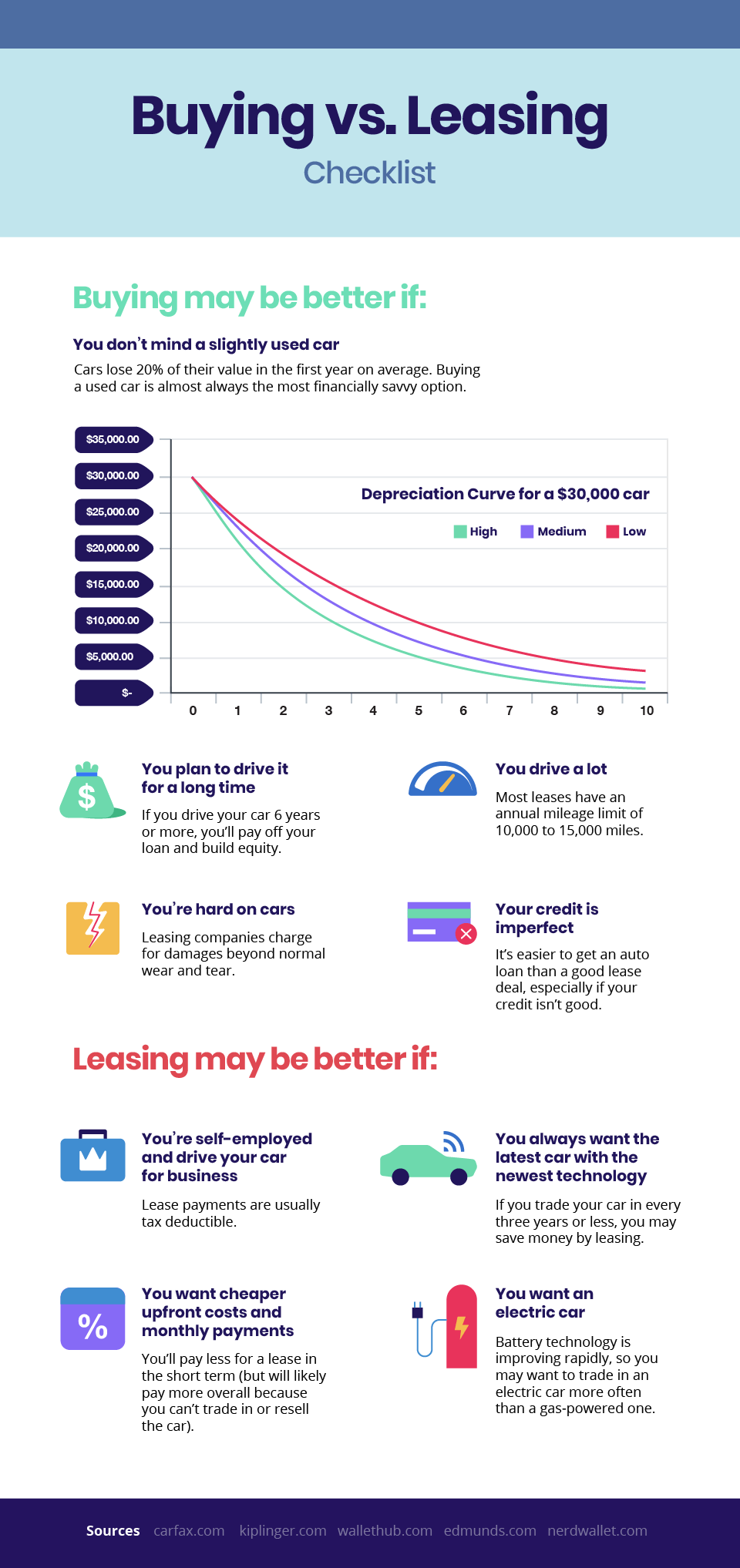

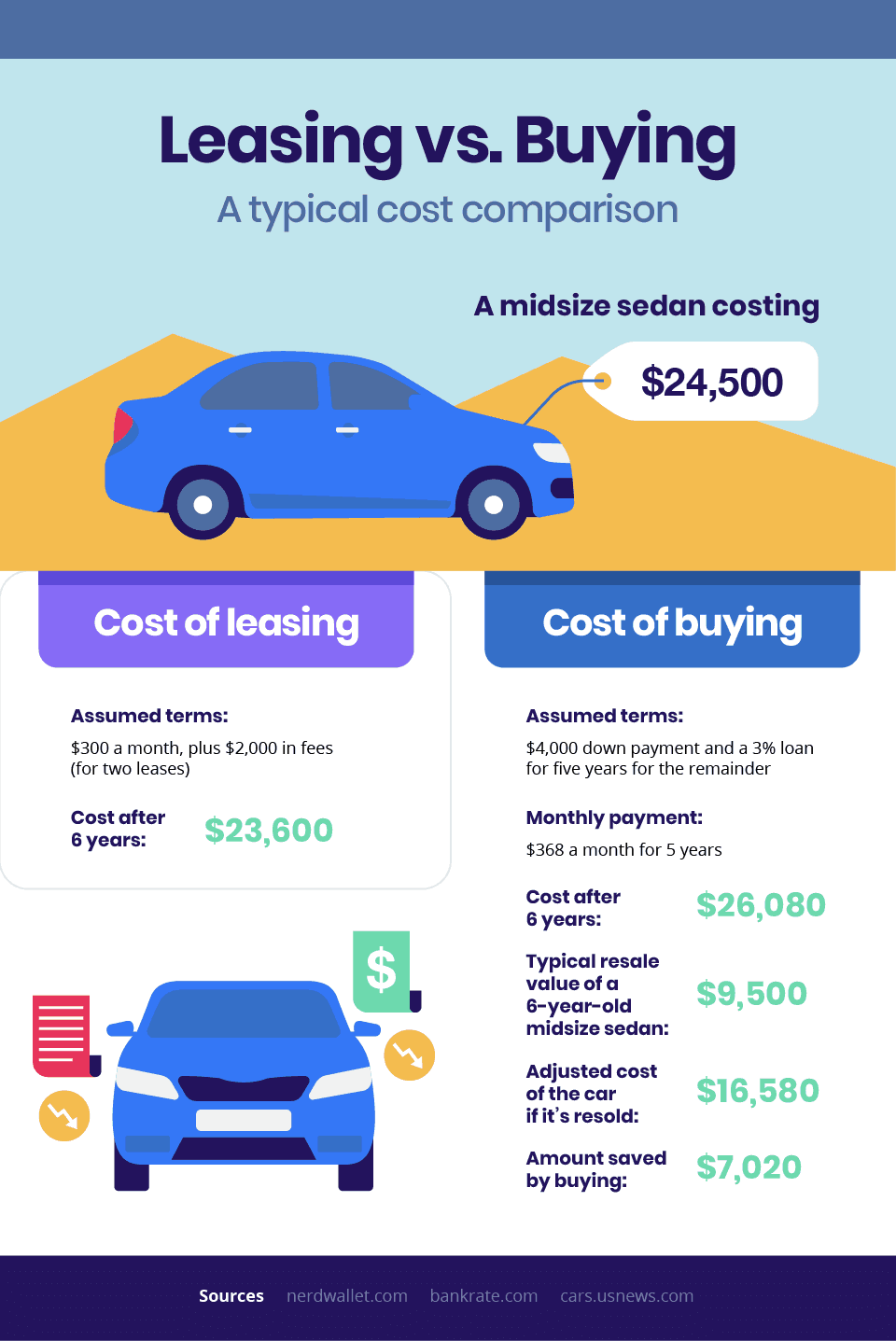

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Is It Better To Buy Or Lease A Car Taxact Blog

Car Accidents With Leased Cars Adam Kutner Attorneys

What Happens If You Crash A Leased Car Gordon Gordon Law Firm

Insuring A Leased Vehicle Bankrate

Is It Better To Buy Or Lease A Car Taxact Blog

What Is Residual Value When You Lease A Car Credit Karma

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

7 On Your Side How To Avoid Car Lease Buy Out Rip Offs Abc7 New York

Amp Pinterest In Action Contract Agreement Lease Agreement Agreement

Just Leased Lease Real Estate Search Property For Rent

Is It Better To Buy Or Lease A Car Taxact Blog

30 Day Eviction Notice Letter Free Printable Documents Being A Landlord Eviction Notice Letter Templates

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

How Much Does It Cost To Lease A Car

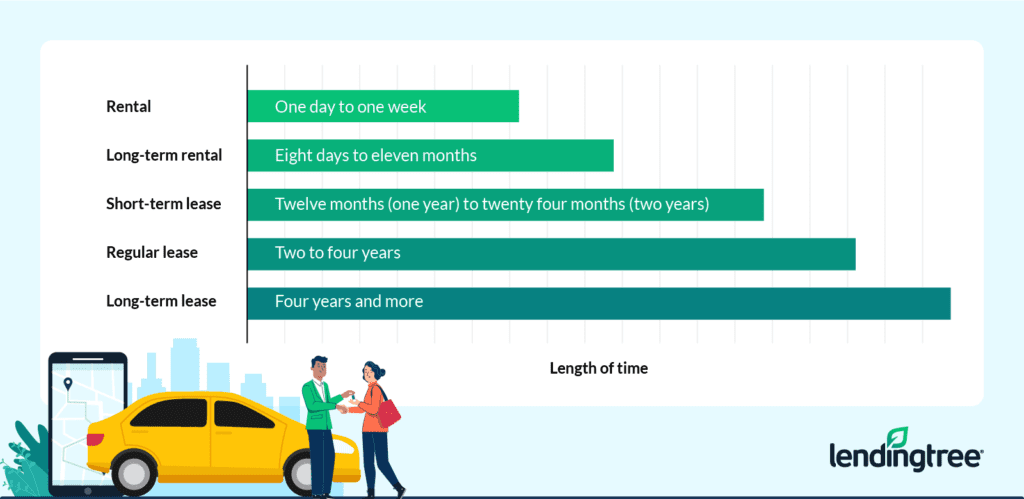

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

Leasing A Car And Moving To Another State What To Know And What To Do