child tax credit payment schedule 2022

Meaning in 2021 18 was the cutoff for CTC eligibility. The amount of the credit is smaller and eligibility is.

Advanced Child Tax Credit Update January 31 2022 Youtube

Within those returns are families who qualified for child tax credits CTC.

. Child income tax credit 20. Stimulus check for advance child tax credit 2022 payments. The Empire child tax credit in New.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. The percentage depends on your income. The monthly payments started in July and ended in December with families receiving in cash up to half the credits total value of 3600 per child under 6 and 3000 per.

Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains unknown. How much is child tax credit for 2022. Freeyearbooksyarncouk For the first.

Live TV Schedule. As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

The child tax credit has been the biggest helper to taxpayers with qualifying children under 18. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the. The advanced payments of the credit will continue in 2022 as.

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. Families could be eligible to. Under the American Rescue Plans rules families with children 17 or younger were eligible for the full child tax credit.

Updated May 20 2022 A1. 2022 Child Tax Credit Payment Schedule. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

As part of the American Rescue Act signed into law by President Joe Biden in. For example if you received advance Child Tax Credit payments for two qualifying children properly claimed on your 2020 tax return but you no longer have qualifying children in. Families who received advance monthly child tax credit payments in 2021 for up to half the value of that credit still.

The maximum child tax credit amount will decrease in 2022. Rhode Island residents can similarly claim 250 per child and up to 750 for three children in a new initiative that has started this month. Child Tax Credit Payment.

2 days agoAbout Catch Up Payments. You can get financial support to help with the costs of your childs tutoring supplies or equipment during the 202223 school year. Child Tax Credit Payment Schedule 2022.

The payment for the. A payment of tax credits for the tax year 2022 to 2023. Explore updated credits deductions and exemptions including the standard deduction.

Oct 17 2022 142 PM EDT. What are advance Child Tax Credit payments. What is the child tax credit.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

Child Tax Credit Payments What S Next

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit When To Pay It Back Fingerlakes1 Com

Here S When You Can Expect The October Child Tax Credit Payment

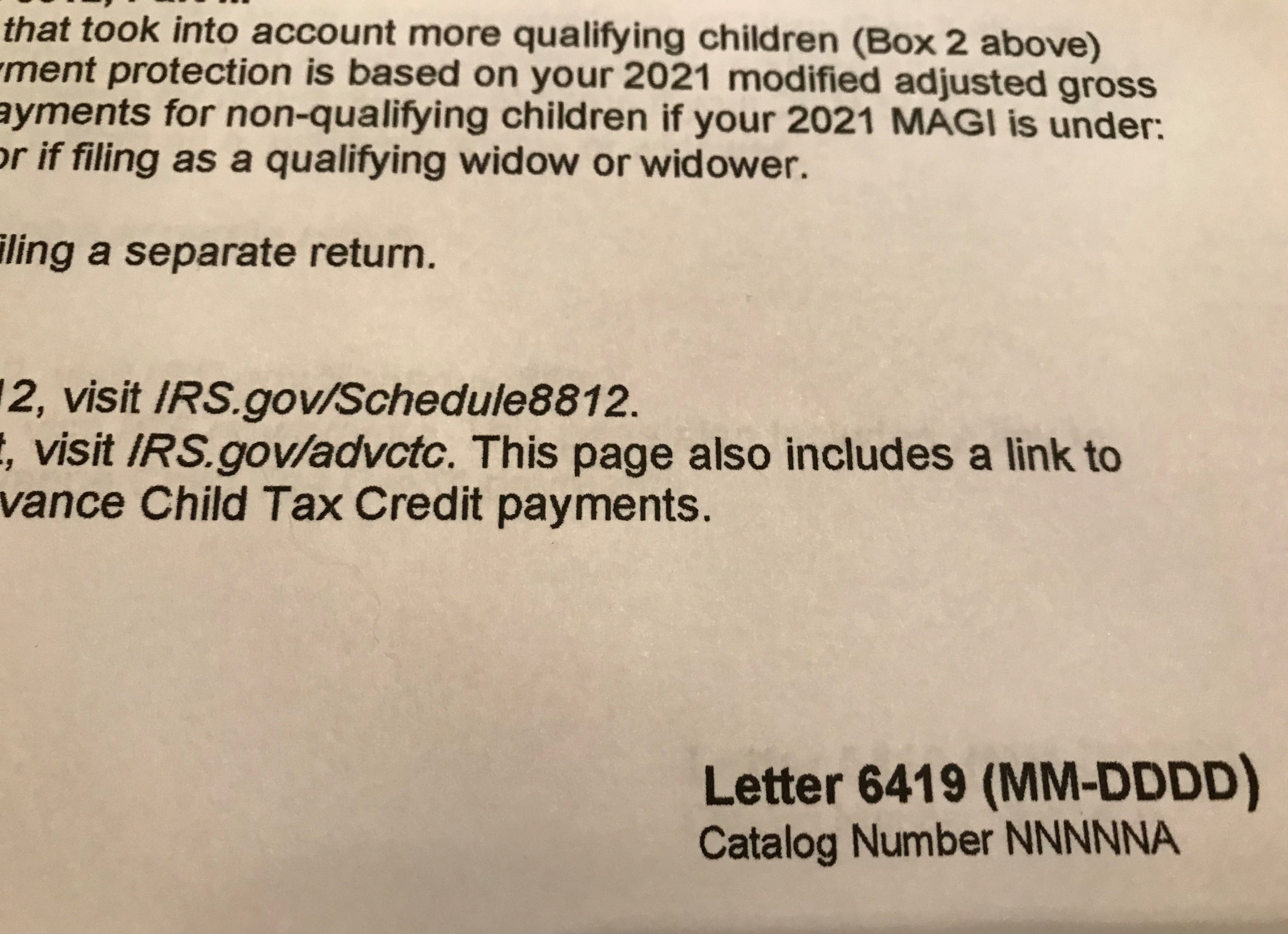

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Will Child Tax Credit Payments Be Extended In 2022 Money

Payment Schedule For Ruby S Income Tax Service Facebook

Appointment Campaign For Working Families Inc

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Deadline To Apply For Ct S Child Tax Rebate Is Sunday

Deadline To Claim Child Tax Credit Fast Approaching Ct News Junkie

What The New Child Tax Credit Could Mean For You Now And For Your 2021 Taxes Newswire

What Families Need To Know About The Ctc In 2022 Clasp

Clearing Up Confusion Surrounding Changes To Child Tax Credit