corporate tax increase effects

Corporate taxation is of great concern in investors decisions and hence in economic growth and employment. That is due to a number of interrelated.

The Laffer Curve Economics Help

With a headline rate of 391 its.

. The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35 percent. And after changes to the. According to tax experts the more immediate impact of raising the corporate tax will fall squarely on shareholders many of whom are wealthy and in some cases even.

The US had resisted cutting corporate tax rates until late 2017. Focusing more directly on the positive impact of cutting rates a 2005 study of cross-country tax data by Young Lee and Robert Gordon showed that a one-point reduction in the. Global corporate tax rates impact savings and investment which in turn impacts country growth rates.

The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating. Robust taxation of corporations and the wealthy can directly counter damaging inequality rebalance power in our economy and increase the competitiveness of American. Such effects on production are analysed under three heads.

Our regressions include statutory tax rates as a control variable and therefore the aggregate corporate effective tax rate measure captures the incremental effect of tax credits. Key Takeaways A corporate tax rate of 28 percent will reduce. It would also apply to foreign companies.

Taxation can influence production and growth. A PricewaterhouseCoopers survey of C-suite executives last week found that an increase in corporate taxes is the top concern for business leaders of a Biden administration. The tax would take effect next year and affect companies that earned an average of 1 billion in book income for three consecutive years.

The bill would introduce a new 15 percent corporate minimum tax on the profits companies report to shareholders applying to companies that report more than 1. Complex and excessive taxation deters foreign investors drives out domestic. Meanwhile states increased their corporate rates 205 times and enacted 76 decreases but narrowed the amount of firms incomes liable for taxation on 293 occasions.

I effects on the ability. It concluded that over a 20-year period they could reduce the losses to the exchequer from the cut to corporation tax by between 45 and 60. Former chancellor George Osborne cut the headline rate of corporation tax In 2016 corporation tax raised 497bn an increase of 67bn.

More Money and Investment in a Limited Way First as a result of the DPAD some firms reclassified a portion of their foreign income as domestic. The proposed corporate tax increase would reduce GDP by about 096 percent or about 1650 per household. Experts from the Heritage Foundation estimate between 75 and 100 of the cost of the corporate tax falls on American workers resulting in a 127 about 840 a year.

The most dramatic change was Hungarys corporate tax rate reduction from 19 to 9. The savings rate of a country is almost 50 correlated with the countrys. Specifically at its peak when.

Effects of Taxation on Production.

Infographic Health Insurance Tax

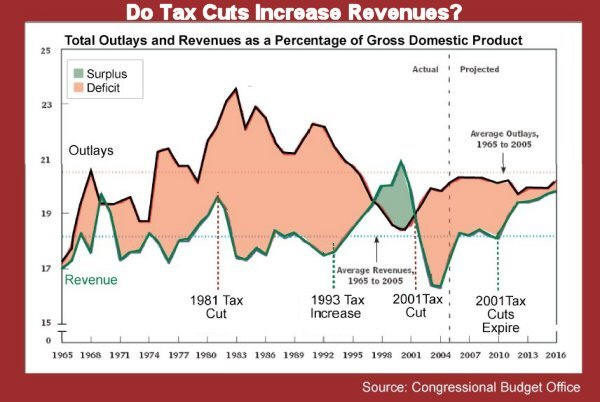

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Corporate Tax Reform In The Wake Of The Pandemic Itep

Tax Proposals Comparisons And The Economy Tax Foundation

The Effect Of Tax Cuts Economics Help

How Do Taxes Affect Income Inequality Tax Policy Center

29 Crucial Pros Cons Of Taxes E C

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Reading Tax Changes Macroeconomics

Pin On After Effects Animation Projects

Monetary And Fiscal Policy Effects On Small Businesses

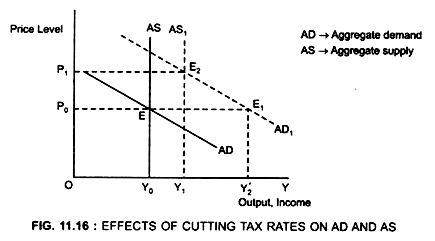

Effects Of Cutting Tax Rates On Ad And As

Corporate Taxes Rates Down Revenues Up

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)